10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 8, 2022

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

For the transition period from _________ to _________

Commission file number 001-40860

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||||||||

Address not applicable1

|

||||||||||||||

(Address of Principal Executive Offices) |

||||||||||||||

(310 ) 691-0776

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | ||||||||

| ☒ | Smaller reporting company | ||||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

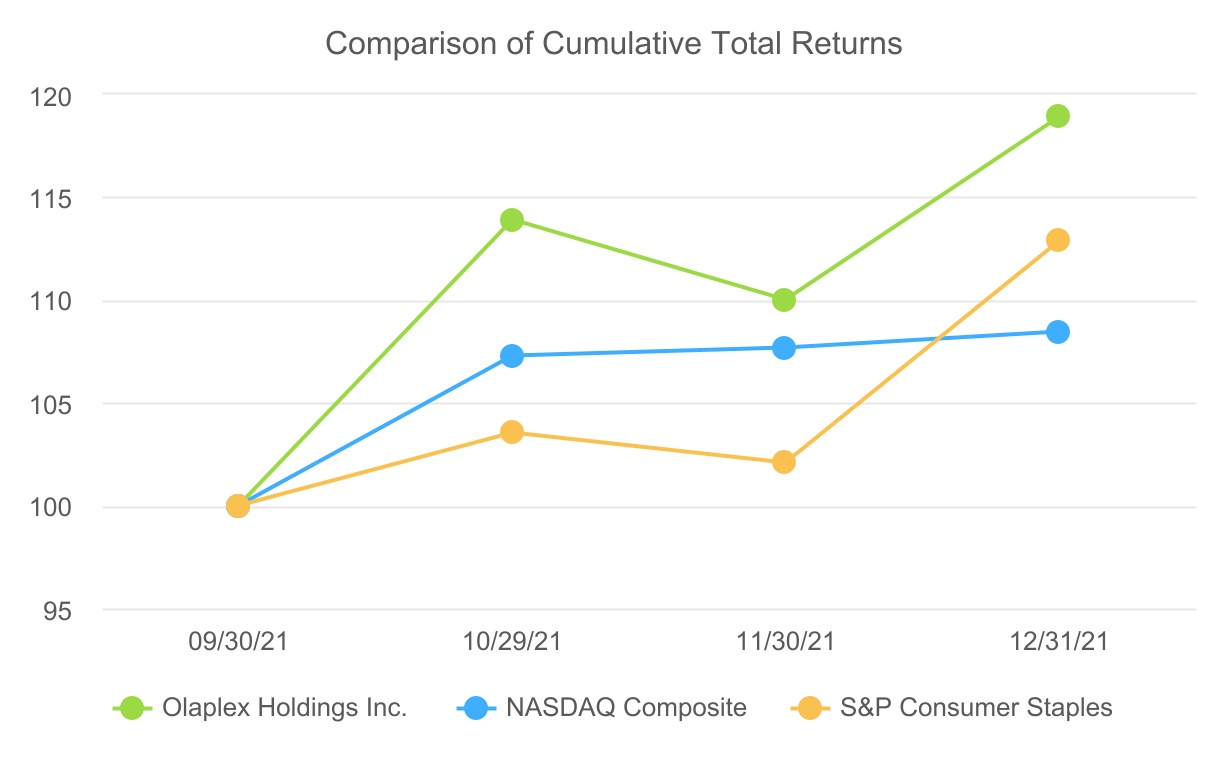

The aggregate market value of voting stock held by non-affiliates of the Registrant on October 8, 2021 was approximately $16.5 billion.

As of February 28, 2022, registrant had 648,794,041 shares of common stock, par value $0.001 per share, outstanding.

1 Olaplex Holdings, Inc. is a fully remote company. Accordingly, it does not maintain a principal executive office.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement relating to its 2022 Annual Meeting of stockholders, to be filed with the Securities and Exchange Commission within 120 days after registrant’s fiscal year end of December 31, 2021, are incorporated by reference into Part III of this Annual Report.

Table of Contents

TABLE OF CONTENTS

| Page | |||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”), including the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains certain forward-looking statements and information relating to us that are based on the beliefs of our management as well as assumptions made by, and information currently available to, us. These statements include, but are not limited to, statements about our strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements contained in or incorporated by reference in this Annual Report that are not historical facts. When used in this document, words such as “may,” “will,” “could,” “should,” “intend,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “expect,” “plan,” “target,” “predict,” “project,” “seek” and similar expressions as they relate to us are intended to identify forward-looking statements. These statements reflect our current views with respect to future events, are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Further, certain forward-looking statements are based upon assumptions as to future events that may not prove to be accurate.

Examples of forward-looking statements include, among others, statements we make regarding: our financial position and operating results; business plans and objectives; general economic and industry trends; business prospects; future product development; growth and expansion opportunities; cybersecurity profile; and expenses, working capital and liquidity. We may not achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place significant reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward- looking statements we make.

3

Table of Contents

The forward-looking statements in this Annual Report are predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements, including such statements taken from third party industry and market reports. You should understand that the following important factors, in addition to those discussed in the section “Risk Factors” included elsewhere in this Annual Report, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements, including the following:

•our ability to execute on our growth strategies and expansion opportunities;

•increased competition causing us to reduce the prices of our products or to increase significantly our marketing efforts in order to avoid losing market share;

•our existing and any future indebtedness, including our ability to comply with affirmative and negative covenants under the 2022 Credit Agreement (as defined herein) to which we will remain subject, until maturity, and our ability to obtain additional financing on favorable terms or at all;

•our dependence on a limited number of customers for a significant portion of our net sales;

•our ability to effectively market and maintain a positive brand image;

•changes in consumer preferences or changes in demand for haircare products or other products we may develop;

•our ability to accurately forecast consumer demand for our products;

•our ability to maintain favorable relationships with suppliers and manage our supply chain, including obtaining and maintaining shipping distribution and raw materials at favorable pricing;

•our relationships with and the performance of distributors and retailers who sell our products to haircare professionals and other customers;

•impacts on our business due to the sensitivity of our business to unfavorable economic and business conditions;

•our ability to develop, manufacture and effectively and profitably market and sell future products;

•failure of markets to accept new product introductions;

•our ability to attract and retain senior management and other qualified personnel;

•regulatory changes and developments affecting our current and future products;

•our ability to service our existing indebtedness and obtain additional capital to finance operations and our growth opportunities;

•impacts on our business from political, regulatory, economic, trade, and other risks associated with operating internationally including volatility in currency exchange rates, and imposition of tariffs;

•our ability to establish and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights of others;

•the impact of material cost and other inflation and our ability to pass on such increases to our customers;

•the impact of changes in laws, regulations and administrative policy, including those that limit United States (“U.S.” ) tax benefits or impact trade agreements and tariffs;

•the outcome of litigation and governmental proceedings;

•impacts on our business from the COVID-19 pandemic; and

•the other factors identified in the “Risk Factors” section of this Annual Report.

These forward-looking statements involve known and unknown risks, inherent uncertainties and other factors, which may cause our actual results, performance, time frames or achievements to be materially different from any future results,

4

Table of Contents

performance, time frames or achievements expressed or implied by the forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Actual results and the timing of certain events may differ materially from those contained in these forward-looking statements.

Many of these factors are macroeconomic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from those described in this Annual Report as anticipated, believed, estimated, expected, intended, planned or projected. We discuss many of these risks in greater detail in the “Risk Factors” section included elsewhere in this Annual Report. The forward-looking statements included in this Annual Report are made only as of the date hereof. Unless required by U.S, federal securities laws, we neither intend nor assume any obligation to update these forward-looking statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations.

RISK FACTORS SUMMARY

An investment in our common stock involves risks. You should consider carefully the following risks, which are discussed more fully in “Item 1A. Risk Factors”, and all of the other information contained in this Annual Report before investing in our common stock. These risks include, but are not limited to, the following:

•Our inability to anticipate and respond to market trends and changes in consumer preferences could adversely affect our financial results;

•Our recent rapid growth may not be sustainable or indicative of future growth, and we expect our growth rate to ultimately slow over time;

•We depend on a limited number of customers for a large portion of our net sales, and the loss of one or more of these customers could reduce our net sales and have an adverse effect on our business, financial condition and/or cash flows;

•Our brand is critical to our success, and the value of our brand may be adversely impacted by negative publicity. If we fail to maintain the value of our brand or our marketing efforts are not successful, our business, financial condition and results of operations would be adversely affected;

•Our future success depends, in part, on our ability to execute our long-term strategy;

•If we fail to attract new customers and consumers, retain existing customers and consumers, or fail to maintain or increase sales to those customers and consumers, our business, prospects, results of operations, financial condition, cash flows and growth prospects will be harmed;

•Our business depends on our ability to maintain a strong community of engaged customers, consumers and ambassadors, including by social media. We may not be able to maintain and enhance our brand if we experience negative publicity related to our marketing efforts or use of social media, fail to maintain and grow our network of ambassadors or otherwise fail to meet our customers’ or consumers’ expectations;

•We rely on single source manufacturers and suppliers for the majority of our products, and the loss of manufacturers or suppliers or shortages in the supply of raw materials or finished products could harm our business, prospects, results of operations, financial condition and/or cash flows;

•Our processing of personal information and other sensitive data could give rise to significant costs and liabilities, which may have an adverse effect on our reputation, business, financial condition and results of operations;

•If we are unable to accurately forecast customer demand, manage our inventory and plan for future expenses, our results of operations could be adversely affected;

• A disruption in manufacturing, supply chain or our shipping distribution and warehouse management network could adversely affect our business, financial condition and results of operations;

•We operate in highly competitive categories;

•We rely significantly on the use of information technology, as well as those of our third-party service providers. Any significant failure, inadequacy, interruption or data security incident of our information technology systems,

5

Table of Contents

or those of our third-party service providers, could disrupt our business operations, which could have an adverse effect on our business, prospects, results of operations, financial condition and/or cash flows;

•Our efforts to register, maintain and protect our intellectual property rights may not be sufficient to protect our business;

•If our trademarks and trade names are not adequately protected, we may not be able to maintain or build name recognition in our markets of interest;

•Our products are subject to federal, state and international laws, regulations and policies that could have an adverse effect on our business, prospects, results of operations, financial condition and/or cash flows;

•We are subject to risks related to the global scope of our sales channels;

•Our significant indebtedness could adversely affect our financial condition;

•Servicing our debt requires a significant amount of cash. Our ability to generate sufficient cash depends on numerous factors beyond our control, and we may be unable to generate sufficient cash flow to service our debt obligations;

•Investment funds affiliated with Advent International Corporation (the “Advent Funds”) have significant influence over us;

•The Tax Receivable Agreement with our Pre-IPO Stockholders requires us to make cash payments to them and exposes us to certain risks. These payments may be substantial and could exceed actual tax benefits, the timing of these payments may also be accelerated and we will not be reimbursed for any payments made under the Tax Receivable Agreement in the event that any tax benefits are disallowed; and

•We are a “controlled company” within the meaning of the corporate governance standards of The Nasdaq Stock Market LLC. As a result, we qualify for, and rely on, exemptions from certain corporate governance standards. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.

6

Table of Contents

PART I

Except where the context otherwise requires or where otherwise indicated, the terms “OLAPLEX” “we,” “us,” “our,” “our company,” “the company,” and “our business” refer to Olaplex Holdings, Inc. and its consolidated subsidiaries.

ITEM 1. BUSINESS

Company Overview

OLAPLEX: Our Mission to Improve Hair Health

OLAPLEX is an innovative, science-enabled, technology-driven beauty company. We are founded on the principle of delivering effective, patent-protected and proven performance in the categories where we compete. We strive to empower our consumers to look as beautiful on the outside as they feel on the inside.

We believe every person deserves to have healthy, beautiful hair, whether they are visiting a salon or caring for their hair at home. Our commitment to deliver results that are visible on first use, coupled with our strong sense of community across both professional hairstylists and consumers, has driven tremendous brand loyalty. We offer our award-winning products through a global omni-channel platform serving the professional, specialty retail, and Direct to Consumer (“DTC”) channels.

Science-Backed Brand that Attracts a Loyal and Engaged Community

We offer science-backed solutions that improve hair health and are trusted by stylists and consumers. We identify our consumers’ most relevant haircare concerns in collaboration with our passionate and highly engaged community of professional hairstylists and consumers, and strive to address them through our proprietary technology and innovation capabilities. Our deep roots in the professional haircare community, and strong ties with our global network of hairstylists, creates a continuous feedback loop that provides unique insight into the hair health goals and concerns of our consumers. Our hairstylists are our strongest advocates; they have grown with our business since our founding in 2014, and through mutual support, we have empowered them to connect with their clients and to champion our brand through an engaged and active social community. This community also provides insight into consumer needs and positions OLAPLEX to leverage our research and development platform to address consumers’ needs for improved hair health by creating high-quality products that result in healthy, beautiful hair. Results have validated our approach. We believe over 90% of our consumers think OLAPLEX products make their hair healthier, which we believe is among the highest ratings compared to competitors in this category. This points to a significant and on-going opportunity for OLAPLEX given over 80% of premium haircare consumers in the United States describe themselves as very focused on the health of their hair and over 90% say they are willing to pay more for more effective haircare products. The quality of our products, combined with our community-driven approach to engaging with both professional hairstylists and our consumers, have created a strong and loyal following for OLAPLEX that we believe provides a unique competitive advantage and foundation for growth.

High Performance Products Proven by Science

OLAPLEX disrupted and revolutionized the professional haircare industry by creating the bond building category in 2014. We have grown from an initial offering of three products sold exclusively through the professional channel to a broader suite of products offered through the professional, specialty retail and DTC channels that have been strategically developed to address three key uses: treatment, maintenance, and protection. Our unique bond building technology is able to repair disulfide bonds in human hair that are destroyed via chemical, thermal, mechanical, environmental and aging processes. We have strategically expanded our product line over time to create a self-care routine that our consumers look forward to and rely upon on a daily basis. Our current product portfolio comprises eleven unique and complementary products specifically developed to provide a holistic regimen for hair health. Our proprietary, patent-protected ingredient, Bis-aminopropyl diglycol dimaleate (“Bis-amino”), serves as the common thread across our products and is a key differentiator in our ability to create trusted, high-quality products. Underpinning our product range is a portfolio of more than 150 patents which protects our proprietary technology and, we believe, creates both barriers to entry and a foundation for us to enter adjacent categories over time. Our patent claims are broadly drafted and include claims covering applications across adjacent categories in haircare and also other categories such as skin care and nail health.

Our current hair health platform is presented below and is championed by three products that can be purchased only through professional hairstylists, No. 1, No. 2 and our 4-in-1 Moisture Mask. These three products often serve as an introduction to our brand and a gateway to eight additional products that can be used both at home and in the salon.

7

Table of Contents

Our Products

| Use Case | Functional Need | Launch Year | |||||||||

|

PRO RX

|

No. 1 | Bond Multiplier | 2014 | ||||||||

| No. 2 | Bond Perfector | 2014 | |||||||||

| 4-in-1 | Moisture Mask | 2021 | |||||||||

|

Treat

|

No. 3 | Hair Perfector | 2014 | ||||||||

| No. 0 |

Intensive Bond Building Hair Treatment

|

2020 | |||||||||

| No. 8 | Bond Intensive Moisture Mask | 2021 | |||||||||

|

Maintain

|

No. 4 |

Bond Maintenance Shampoo

|

2018 | ||||||||

| No. 5 | Bond Maintenance Conditioner | 2018 | |||||||||

| No. 4P | Blonde Enhancer Toning Shampoo | 2021 | |||||||||

|

Protect

|

No. 6 | Bond Smoother | 2019 | ||||||||

| No. 7 | Bonding Oil | 2019 | |||||||||

Note(s): No.1, No.2, and No.4-in-1 are only available for professional use, whereas the other products are sold across all of OLAPLEX’s channels.

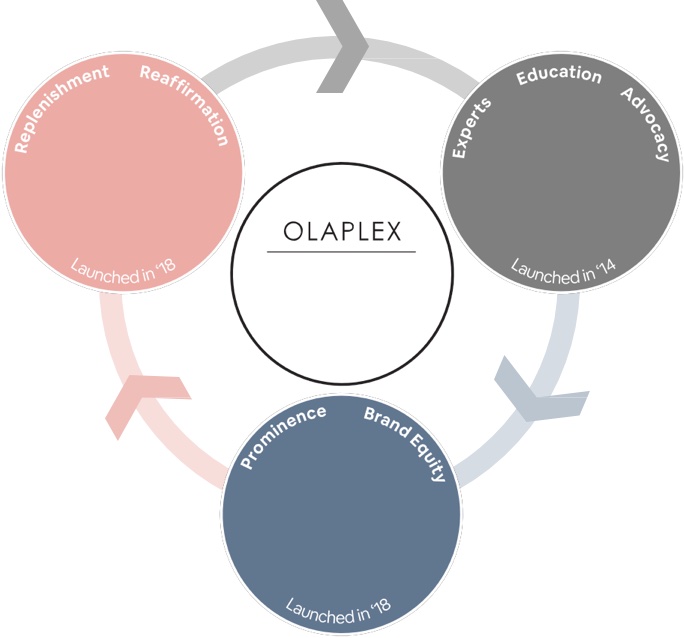

Synergistic Channel Strategy Underpinned by Our Omni-Channel Approach

We have developed a cohesive and synergistic distribution strategy that leverages the strength of each of our channels, including the specific attributes of each channel as depicted below, and our strong digital capabilities that we apply across our omni-channel sales platform.

We launched our first product in 2014 through the professional channel in order to build trust and support within the hairstylist community. Our professional channel, which includes both products used by hairstylists in-salon and products sold by hairstylists to consumers for use at home, comprised 43% of our 2021 total net sales and grew 66% from 2020 to 2021. The professional channel serves as the foundation for our brand, validating the quality of our products and influencing our consumers’ purchasing decisions. We believe the leading factor that drives purchasing decisions of haircare products is the recommendation from consumers’ stylists, exceeding other factors such as celebrity endorsements, advertisements online or in traditional media. We also believe that use of a particular product by hairstylists is the #1 driver of consumer brand awareness.

In 2018, as OLAPLEX continued to grow, we established our retail presence through expansion into the DTC channel and specialty retail channel (principally Sephora), both of which have continued to grow as we have developed our omni-

8

Table of Contents

channel platform. Our specialty retail channel grew 247% from 2020 to 2021, representing 29% of our 2021 total net sales. Our DTC channel, comprised of OLAPLEX.com and sales through third-party e- commerce platforms, grew 117% from 2020 to 2021, and represented 27% of our 2021 total net sales. This channel also provides us with the opportunity to engage directly with our consumers, and create a feedback loop that drives our decisions regarding new product development, marketing and communications strategies.

Since our first product launch, we have focused on developing clean, technology-based beauty products and creating powerful engagement between professional hairstylists and our consumers, which has driven strong organic growth.

Commitment to Social and Environmental Consciousness

We are passionate about promoting wellness, starting with the integrity of your hair and extending to supporting our communities and minimizing our impact on the environment, allowing us to drive social and environmental awareness in the beauty industry.

•Supporting Small Businesses. We are invested in the success of our hairstylist community as their businesses grow alongside ours. We are especially focused on providing support to the small business community and minority hairstylists; currently 98% of our salon community is made up of small businesses and a meaningful percentage of our hairstylists are racial or ethnic minorities. During the height of the COVID-19 pandemic in 2020, we implemented several initiatives to support hairstylists during salon closures. One example is our Affiliate Program that allowed hairstylists to connect with their consumers and generate income by selling OLAPLEX products for at-home use. This program generated more than $300,000 in income for our professional hairstylist community during a time when their salons were closed.

• Diversity, Equity, and Inclusion. We believe it is important that our employees reflect the diversity of our hairstylist and consumer community. Our Diversity, Equity, and Inclusion (“DEI”) initiatives focus on promoting a workplace of inclusion and acceptance. As a result of our efforts, we have created a diverse workplace environment with 76% of our employees identifying as female and 46% identifying as non-white, as of December 31 2021. We are especially proud that our diverse workforce reflects the community of professional hairstylists we serve, of which 92% identify as women and 37% identify as African American, Asian or Latino as of December 31, 2021. Many of our current Olaplex employees are former stylists whose unique perspectives and insights have helped us better understand our diverse consumer base and what matters to them. Additionally, nine of the 11 members of our board of directors (the “Board of Directors”) are female, and we believe our shared commitment to diversity helps us better understand our professional consumer base and connect with the hairstylist community. We are also proud of the fact that an employee survey from February 2021 found that 90% of our employees agree that we have an inclusive environment that makes them feel comfortable bringing their true selves to work.

•Environmental Sustainability. We continue to explore ways to reduce our carbon footprint and contribute to a more sustainable future for our planet. By taking preventative measures, we’re able to lighten our carbon footprint and do our part in making the world a better place. One of our key initiatives is to reduce the impact of packaging. We are focused on limiting the use of secondary packaging in which our products are sold. By pursuing these packaging reduction initiatives, we believe that between 2015 to 2021 we avoided the use of approximately 4.4 million pounds of paper packaging, which we believe prevented approximately 35 million pounds of greenhouse gas from being emitted into the environment, conserved approximately 57 million gallons of water and saved approximately 44,000 trees from deforestation, as compared to manufacturing, packaging and distribution alternatives. In addition, we strive to produce clean products that exclude certain harmful ingredients. These efforts are well recognized in the industry. As of December 2021, OLAPLEX is one of only 26 haircare brands (out of 74 total haircare bands sold by Sephora) accredited with the “Clean at Sephora” designation, which is defined as products that are free from over 50 ingredients including sulfates, parabens, phthalates, mineral oil, and formaldehyde

Scaled and Nimble Supply Chain

We have developed a flexible and resilient supply chain, designed to support long-term growth at scale. A core tenet of this strategy is leveraging strong partnerships with our co-manufacturers and distributors to create an expansive supply network with ample capacity without significant additional capital investment. Maintaining an asset-light business model has helped us to generate strong free cash flow.

Robust Financial Performance

The strength of our business model and ability to scale has created a compelling financial profile characterized by revenue growth and very strong profitability over the past two years. Our net sales increased from $282.3 million in 2020 to $598.4 million in 2021, representing a 112% increase. Our net income increased from $39.3 million in 2020 to $220.8 million in 2021, representing a 462% increase, primarily as a result of an increase in sales in 2021 and the absence of one-time fair value inventory adjustment due to the acquisition of the Olaplex business by Advent (the “Acquisition”) on January 8, 2020 (the “Acquisition Date”). Our adjusted net income increased from $131.1 million in 2020 to $275.7 million in 2021,

9

Table of Contents

representing a 110% increase, primarily as a result of increased sales. We have experienced robust adjusted EBITDA growth over the past year, from $199.3 million in 2020 to $408.8 million in 2021, representing a 105% increase. Our adjusted EBITDA margins went from 70.6% in 2020 to 68.3% in 2021 reflecting the investments necessary to scale our business. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for additional information regarding our financial performance and non-GAAP measures, together with a reconciliation of non-GAAP measures to their most directly comparable GAAP measures.

Our Market Opportunity

Haircare Represents a Large, Growing Market

Haircare represents a large, addressable market and presents significant opportunities for growth. In 2021, consumers spent an estimated $82 billion globally on haircare products (a figure that does not include the billions consumers spend on haircare services and stylists spend on back-bar products), with consumer spend anticipated to grow at a compound annual growth rate of approximately 5% from 2021 to 2025. OLAPLEX participates in the prestige segment of the market, which is expected to be the fastest growing segment of the global haircare market from 2021 to 2025.

Consumers are Increasingly Focused on Health and Wellness

In particular, we focus on hair health, a key driver of our consumers’ purchasing decisions across the globe. Our first area of focus was damaged hair, among the most important components of hair health, which we addressed through our proprietary bond building technology. Hair damage is a widespread issue. For example, we believe approximately 90% of premium haircare consumers in the United States and 98% of premium haircare consumers in China regularly inflict damage to their hair, such by coloring, chemical services, heat styling, or washing and brushing, which we believe has driven strong demand for our bond-building products.

Several significant tailwinds support the long-term growth prospects of the haircare market. The way our consumers feel about their hair has a strong impact on how they perceive themselves; we believe that continued focus on personal appearance and wellness will drive increased spend in the category. We believe consumers are also becoming increasingly health-conscious, generating a high demand for clean, technology-backed beauty products that achieve results, and that the importance of hair health has driven increased willingness among our consumers to invest in premium-quality products. Our offerings, which are able to deliver results after the first use, position us well to meet this rising consumer demand. In addition, we have seen a shift in demand for haircare products to omni-channel retailing and online shopping, in particular. Our omni-channel strategy positions us well to connect with our consumers globally across channels, and to grow our market share.

Innovative, Consumer-Connected Brands Are Taking Share

As consumers increasingly demand high-performance and innovative solutions for hair health, we believe that the haircare industry is ripe for disruption. Heritage beauty brands have lost market share to innovative, consumer-connected brands that are more agile and better equipped to meet evolving consumer needs. According to Euromonitor on DATE, the top three haircare companies globally (by retail sales) have lost over 430 basis points of market share since 2015. This shift in consumer demand has created a significant opportunity for OLAPLEX to gain market share. Increasing focus on hair health also provides significant runway for future growth as we extend our product offering to focus on providing other haircare solutions.

Whitespace in the Broader Beauty and Wellness Category

We also are well positioned to expand into the broader beauty and personal care category by leveraging our differentiated technology platform, and we believe consumers would be interested in OLAPLEX product offerings in other beauty categories, such as the $155 billion skincare market. We intend to utilize our innovation expertise to enter adjacent categories and create clean, healthy solutions for the broader personal care needs of our consumers. Our rigorous product development process combines a deep knowledge of science with community-driven testing and feedback, as we work with professional hairstylists to develop and test new products before they launch. We are confident that our deep connection with our consumer community will allow us to expand into beauty and wellness categories in the future.

Our Strengths

Differentiated Brand Positioning Steeped in Science-Backed, Proven Products

OLAPLEX is built upon a vision of delivering scientific hair health solutions to both professional hairstylists and consumers. We believe that demand for OLAPLEX products is driven by the visible results of our products, and that our ability to provide scientifically supported hair health solutions has engendered trust, loyalty, and advocacy among our

10

Table of Contents

consumers across channels. This has enabled OLAPLEX to become the #1 bond-building haircare brand in the professional channel, and a top ranked haircare brand within our specialty retail channel. Furthermore, we believe that over 80% of premium haircare consumers who have considered purchasing OLAPLEX believe that OLAPLEX is a brand they can trust and that could help them take care of their hair, with over one-third of OLAPLEX users as of September 2021, strongly agreeing with the statement, “OLAPLEX is my favorite haircare brand”. OLAPLEX also has a loyal customer base at BSG, a network of stores and direct sales consultants selling professional salon brands to professional hairstylists, with over 170,000 returning customers between 2020 and 2021 alone. We believe we have continued to rank as a top selling brand, including Company estimates that we are the #1 Haircare Brand and top 25 Beauty brand in all classes of beauty at Amazon in the U.S. and #1 Haircare brand on Look Fantastic in the United Kingdom (“U.K.”) as of December 31, 2021.

Beloved Brand with Passionate and Loyal Consumer Following

Our dedication to providing science-driven-solutions has created an engaged consumer base that we believe advocates authentically for the quality of our products. Our unique relationship with stylists and active involvement with them through digital forums, OLAPLEX Pro App and as brand ambassadors has driven community engagement that has fostered loyalty among the consumer community as well. We continue to build loyal relationships with elite hairstylists and brand ambassadors who educate our consumers, test our products, participate in our brand campaigns and introduce our products to their clientele. Our brand ambassadors also have leadership influence and reach throughout the hairstylist community which reinforces our brand positioning. We believe our products’ quality and ability to deliver visible results after first use, coupled with our solutions- based product system, has led to deep penetration within the purchasing habits of our consumers. We believe consumers who purchase at least one OLAPLEX product on average have purchased over 3.5 other products from our product suite in the last twelve months. We believe this broad cross-purchasing activity demonstrates that consumers are using our products as part of a broader haircare regimen.

Furthermore, our consumers have continued to engage with the OLAPLEX brand online. As of December 31, 2021, the OLAPLEX hashtag has been used over 12.9 million times across social media platforms by our community of professional hairstylists and consumers who create their own content about their haircare regimen. In the past year, we had exceptional engagement with our Instagram community of over 2.3 million followers as of December 31, 2021, which generated 2.6 million likes and an average of approximately 13,500 story views a day. Our passionate consumer base is also demonstrated by our presence on TikTok where our videos have been viewed over 10.6 million times between October 2021 and December 2021, and, as of December 2021, videos using the OLAPLEX hashtag have been viewed over 542 million times since the hashtag first appeared on the platform.

Positioned in Compelling Sub-Verticals

We believe our focus on large, high-growth segments of the haircare industry separates us from our competitors. Our products address the most relevant categories within haircare: treatment, maintenance and protection. Maintenance is one of the largest haircare subcategories and consists of products such as shampoos and conditioners. Our shampoo and conditioner products are key areas of focus and have experienced growth of more than 100% from 2020 to 2021 . We believe that treatment and protection are two areas that consumers are most concerned about, and therefore are categories that deliver strong loyalty where consumers are less likely to switch brands and products. We believe over 70% of consumers have experienced one of the following: hair loss, damage, coarseness, thinness, frizz, or dryness. We help consumers address many of these haircare concerns with our patented and proven Bond Building Hair Treatment, Hair Perfector and Bond Intense Moisture Mask.

Powerful Product Portfolio Supported by Proven Innovation Capabilities

Our innovation capabilities and unique approach to product development have allowed us to develop a portfolio of powerful, patent-protected and proven hair health solutions. In seeking to address the most important concerns in hair health, we incorporate feedback from our community of professional hairstylists and consumers into solution-oriented products that speak to our consumers’ needs. These consumer insights inform the efforts of our in-house research and development team, dedicated OLAPLEX laboratory, independent lab testing, and real- world salon testing, creating a virtuous feedback loop. Bis-amino is an example of science-enabled technology. This molecule is the formulating ingredient in all of our products and addresses a root cause of damage by repairing broken hair bonds.

We have a strong track-record of successful product launches. The launch of our No. 0 Intense Bond Building Treatment created exceptional social media engagement, which resulted in our product ranking as the #1 selling SKU at Sephora during the first weeks following its launch, according to Sephora’s internal reporting. Similarly, the launch of our No. 8 Bond Intense Moisture Mask was the biggest haircare launch in 2021, as of July 2021, at Sephora based on sales. No. 8 has also performed well within our professional hairstylist community, resulting in it becoming the number one product at BSG in April 2021. In addition, No. 8 generated over $7 million in sales and sold over 400,000 units within the first three weeks of launching in March 2021 at our top U.S. accounts and represented the largest launch in our history by net sales. The launch of the 4-in-1 Moisture Mask made it the best-selling product at BSG for the month of August and generated over $2.5M million in sales at BSG and Salon Centric combined. No. 4P Blonde Enhancer Toning Shampoo had a successful launch with it being the best-selling product at BSG for the month of October 2021. Additionally, it launched as the #2

11

Table of Contents

Shampoo in the total Shampoo category at Sephora and continues to be the top selling purple shampoo at Sephora. We are supporting our future innovation pipeline through the development of new technology that seeks to address other key components of hair health.

Synergistic Omni-channel Strategy and Market Leadership Across Channels

Our integrated channel strategy across the professional, specialty retail and DTC channels creates a powerful feedback loop that reinforces consumer spending across channels. Our digital capabilities support each of our channels and provide us with direct touchpoints with our consumers. We believe that our professional channel provides credibility as a trusted source of product recommendation to our consumers, thereby supporting our specialty retail and DTC channels by serving as an introduction to our brand. We believe that approximately 35% of our consumers purchase OLAPLEX products after being introduced to the product by their hairstylist. Once this introduction is made, our consumers often begin purchasing our products through our specialty retail and DTC channels. We offer our retail partners a curated portfolio of highly productive products with incremental benefits, which contrasts starkly with many brands’ broad assortments. Our specialty retail and DTC presence allows us to reach our consumers everywhere they shop, and drives revenue to professional hairstylists when clients seek professional-strength OLAPLEX treatments in the salon to complement at-home use. This cycle has driven significant cross-channel shopping opportunities and is supported by our digital initiatives: for example, we believe nearly 50% of our customers that purchase product on OLAPLEX.com have also purchased OLAPLEX products in retail locations and 40% have also purchased in a salon. This integrated channel approach has also driven strong growth across channels and geographies as we have expanded. Our recent expansion in the U.K. illustrates the success of our approach. In 2019, we improved our professional distribution network in the U.K, which expanded our salon presence. We then focused on developing our DTC and specialty retail channels in 2020 and 2021. As a result, from 2020 to 2021, net sales in our professional channel grew 66% and in our specialty retail channel grew 247%, highlighting the additive relationship between our channels. Our ability to succeed across channels is a hallmark of our business model. For example, in 2021, OLAPLEX was the #1 selling haircare brand at Sephora and 5 of our products were the best-selling in their respective categories at BSG. In addition, we believe that during July 2021 our No. 0 + No. 3 kit and No. 5 solutions were two of the top ten haircare products sold on Amazon. Our expanding brand resonance and community of stylists allows us to leverage this integrated channel strategy internationally as well, with strong footholds within professional communities supported by presence in key specialty retailers and recent expansion into DTC.

Experienced and Visionary Management Team and Board

Our strategic vision and culture are directed by our skilled management team, who collectively have decades of strategic and operating experience in the beauty and luxury fashion industries. Our leadership is further augmented by a board of directors with leadership experience in beauty, innovation, digital, marketing and operations.

Grow Brand Awareness and Household Penetration

There is significant opportunity to continue to grow brand awareness and educate consumers about OLAPLEX and the benefits of our solution-based regimen. We believe that OLAPLEX has an average, higher unaided brand awareness that is over twice that of our peers, with just 7% unaided awareness versus that of a competitor median of just 3% unaided awareness. and also has aided awareness of 59% compared to a median of 65% for our peers. At Sephora, a key retail account, approximately only 9% of shoppers purchased an OLAPLEX product in 2021 despite the fact that we believe we were the #1 haircare brand sold at Sephora in 2020. As of December 31, 2021, our powerful digital community includes more than 100 brand advocates, including licensed cosmetologists supporting our content creation, two professional-dedicated communities on social media consisting of over 250,000 hairstylists and several company-operated accounts including on Instagram, TikTok, Facebook and other social media platforms, where we have demonstrated robust followership and engagement. Our recent digital engagement efforts have been instrumental in attracting a younger consumer demographic to our brand. We believe that 44% of our consumers, as of December 2021, are between the ages of 18 to 34, compared to an average of 33% in the premium haircare category. We plan to continue to grow our social media engagement by increasing our digital marketing spend and expanding our capabilities to interact with our consumers through OLAPLEX.com and other digital channels. We also plan to grow our brand awareness by continuing to deepen our relationships within the professional community. As our total product portfolio grows, we also expect our brand visibility to increase as more consumers are introduced to our brand through new product offerings. We believe these efforts to expand awareness and household penetration will enable the OLAPLEX brand to continue growing in the future.

Continue to Grow OLAPLEX Through Existing Points of Distribution

We plan to drive sustained growth in our core channels by increasing repeat purchase rates and brand awareness. As we have expanded, we have demonstrated our ability to drive continued growth with existing customers, as evidenced by our products generating growth of more than 95% in sell-through sales from 2020 to 2021 in Sephora locations in the U.S., which we believe to be well in excess of our competitors. In addition, our core products represented five of the top ten selling products at Sephora during December 2021. Within the professional channel, we intend to expand our consumer

12

Table of Contents

base of professional hairstylists by growing our brand ambassador community and increasing adoption of our professional-only offerings. Similarly, within specialty retail, our low penetration levels among Sephora customers and relatively limited brand awareness provide us with strong growth opportunities in their existing locations and our products will be available as part of the Sephora at Kohl’s partnership which rolled out to 200 Kohl’s locations in the Fall of 2021 and is expected to expand to a total of 850 stores by 2023. Furthermore, within our DTC channel, we continue to see opportunities to enhance OLAPLEX.com, including our recently developed hair diagnostic test to engage and educate our consumers. Since we began offering our online diagnostic platform in October 2020, over 1.7 million unique consumers have taken the OLAPLEX hair diagnostic test and shared their haircare needs with us.

Expand Distribution to New Geographies and Retailers

We plan to pursue large and meaningful distribution opportunities and increase existing depth across specialty retail, travel retail, specialty pharmacy, professional salons and international markets. We expect to continue to grow our retail distribution by establishing commercial relationships with new customers. For example, in the fourth quarter of 2021, we successfully launched our professional offerings in Ulta salons and in January of 2022, our retail products became available at each of Ulta’s more than 1,250 stores and on ulta.com.

Internationally, we intend to capitalize on our current broad professional salon base and growing retail brand awareness to deepen our reach in existing key markets by utilizing our omni-channel approach with enhanced marketing and social media efforts. In Europe, we particularly see an opportunity to attract more consumers in select countries by partnering with high-end specialty pharmacies to expand our points of distribution. In Asia, key areas of focus include accelerating our partnership with Tmall Global in China and broadening our existing distribution channels in Japan. Furthermore, we continue to explore entry and growth opportunities in Latin America where we have a smaller presence compared to other geographies.

Expand our Product Offerings by Utilizing Innovation Capabilities

We plan to continue to leverage our product-solution brand mindset, consumer relevance and brand strategy to expand into new categories. Our dedicated R&D department’s unique approach to innovation supplies us with a meaningful pipeline of haircare opportunities that we believe resonate with our in-house OLAPLEX hairstylists and our consumers. We internally develop our products in our lab and in partnership with national co-manufacturers, universities, and biotech companies to be on the cutting edge of haircare technology. Our large and expanding community of professional hairstylists helps us selectively test our products in real world scenarios, which enables us to gain rapid consumer insights and product feedback. We see opportunities to extend our product technology to new areas of hair health and treatment, such as scalp care, as well as other haircare categories in which we have yet to participate. We are also developing other potentially patentable technologies to support extension into non-haircare beauty and wellness categories that provide us with long- term growth opportunities. For example, we believe that approximately 82% of consumers familiar with OLAPLEX would like to see an OLAPLEX skin care line, and 51% of these consumers would switch out their current skin care for an OLAPLEX product. We plan to continue to leverage our powerful research and development strategy to create new products and provide technology-based beauty solutions for our consumers.

Leverage OLAPLEX.com to Strengthen our Direct To Consumer Channel

We plan to continue to invest in our digital marketing capabilities and online platform to increase our DTC presence and attract more consumers to our brand. We expect to grow our DTC channel by creating new tools and programs available on our website that interact with our consumers and help them use our products. Specifically, we believe we have an opportunity to gain greater insights from our consumers and enhance connectivity by offering customized feedback for each of their haircare needs. We recently launched an online hair diagnostic tool on OLAPLEX.com that enables us to better engage with our consumers and listen to the most important haircare concerns they face. We envision expanding our omni-channel platform to offer multiple hair health solutions to our consumers based on the feedback they provide us. Our DTC capabilities and omni-channel platform are critical to achieving future revenue growth and further developing and nurturing the strong connection we have with our consumers. Key areas of focus in our DTC channel strategy include creating new revenue opportunities, increasing the cross-product purchasing patterns of our online consumers and highlighting our DTC channel when expanding in new international geographies such as U.K., Australia and France.

Our Synergistic Omni-Channel Sales Platform

Our products are sold through our global omni-channel platform in more than 60 countries across the world. In 2021, approximately 58% of our net sales were generated in the U.S. and approximately 42% of our net sales were international. We sell our products through distributors, retailers, and directly to consumers.

Professional Channel Rooted in our Hairstylist Community

13

Table of Contents

In our professional channel, our products are sold primarily through wholesale beauty supply distributors who sell to professional beauty industry outlets, such as salons and licensed cosmetologists, for use in the salon or for hairstylists to sell to consumers for use at home. In 2021, we sold our products through over 100 professional distributors. Our international distributors are generally only permitted to sell our products to professional beauty industry outlets in specific territories, with some having the exclusive right to sell our products in the territory. Our agreements with professional beauty distributors also typically contain minimum purchase and sell-through requirements and prohibit the distributor from selling products deemed competitive with ours.

Specialty Retail Channel Focused on Reaching Consumers

Our specialty retail customers include specialty retailers, as well as luxury department stores with online and/or brick and mortar presences. In 2021, we sold our products through approximately 30 retailers in more than 60 countries throughout the world. Our biggest global retail partner is Sephora, where we are in more than 1,800 doors globally as well as through Sephora’s own e-commerce sites.

Direct to Consumer Channel Leveraging our Digital Capabilities

We sell our products directly to consumers through our branded website, olaplex.com, and to industry leading pure play beauty and wellness partners. We have dedicated resources to implement creative, coordinated, brand- building strategies across our online activities to increase our direct access to consumer insights, engagement and conversion, which further enhances our innovation and branding performance.

Marketing and Engagement with Our Customer and Consumer Community

Our strategy to market and showcase our products begins with our omni-channel platform across the professional, specialty retail and DTC channels.

In our professional channel, we market our products using educational seminars on our products’ application methods and consumer benefits. We have a dedicated portal on our website for professional customers to purchase and learn more about our products and have developed a mobile app for our professional community that serves as a resource on our brand and products and offers us the opportunity to more directly engage with hairstylists about our products. In addition, we use professional trade advertising, social media and other digital marketing to communicate to professionals and consumers the quality and performance characteristics of our products. We believe that our presence in professional salons benefits the marketing and sale of our products sold through our specialty retail and DTC channels as it introduces consumers to our products who may start shopping through our other channels in addition to shopping at the salon.

In our specialty retail channel, we support our authorized retailers to drive in-store and e-commerce sales of our products, and work with them to ensure the optimal presentation of our products in their stores or on their e-commerce sites. Advertising activities, in-store displays, and online navigation are designed to attract new consumers, build demand and loyalty and introduce existing consumers to other product offerings. Our marketing efforts also benefit from cooperative advertising programs with some retailers. We typically do not use promotional activities in our marketing efforts but may occasionally offer limited-time product kits to help introduce our products to consumers.

Our digital first approach to performance marketing is designed to offer best-in-class customer experience on olaplex.com, from load times, site navigation to a more intuitive check-out experience, all of which is designed to increase brand awareness, site traffic and conversion.

We continue to increase our brand awareness and sales through our strategic emphasis on performance marketing and by leveraging technology. We see opportunities to further enhance our online presence and consumer engagement through our digital properties, especially as the COVID-19 pandemic has had a significant impact on consumer behaviors and has accelerated the trend for a digital-first consumer journey and e-commerce, and we continue to elevate our digital presence encompassing e-commerce and m-commerce, as well as digital, social media and influencer marketing and engagement. We have top celebrity hairstylists and colorists from around the world as Olaplex brand ambassadors. These brand ambassadors help market our brand through educational events, social media and other publicity. We also are investing in new analytical capabilities to promote a more predictive and personalized experience across our sales channels. For example, we developed an online hair diagnostic quiz that allows consumers to discover our products to identify and personalize their hair health needs. We continue to innovate to better meet consumer shopping preferences, support e-commerce and m-commerce via digital and social marketing activities designed to build brand equity and consumer connection, engagement and conversion.

Our Innovative Products

14

Table of Contents

Fueled by our focus on providing solutions to improve our consumers’ hair health, we have created a holistic product line employing our unique bond building technology that repairs and relinks disulfide bonds in human hair that have been destroyed or compromised by chemical, thermal, mechanical, environmental and aging processes. Our proprietary, patent-protected ingredient, Bis-amino, serves as the common thread across our products and is a key differentiator in our ability to create trusted and high-performing products. Underpinning our product range is a portfolio of more than 150 patents, which protects our proprietary technology and, we believe, creates both barriers to entry and a foundation for entry into adjacent categories over time.

Our current product portfolio comprises eleven unique, complementary products specifically developed to provide a holistic regimen for hair health. The quality of our products drives consumer enthusiasm, strong repurchase trends and basket building behavior. Because our products augment each other, our consumers often utilize multiple products within our line that work together to lead to consistently healthy hair—we believe this additive phenomenon drives exceptional consumer loyalty.

Our current product suite is championed by three professional use-only products: OLAPLEX Bond Multiplier (No. 1), OLAPLEX Bond Perfector (No. 2) and OLAPLEX 4-in-1 Moisture Mask. These three products often serve as an introduction to our brand, and a gateway to eight additional products that can be used at home, including a bond building treatment (No. 0), Hair Perfector (No. 3), shampoo and conditioner (No. 4 / 5 / 4-P), Bond Smoother (No. 6), Bonding Oil (No. 7) and Bonding Moisture Mask (No.8). Each product is created with our consumer in mind and with high-quality ingredients backed by scientifically proven formulas and independently validated claims. We also offer combination kits comprising related products to drive new customer acquisitions and trial.

Customers

We have over 180 customers across our omni-channel sales platform. Our customers in the professional channel include SalonCentric, Beauty Systems Group, Ulta salons, New Flag, Sally U.K., and Aston and Fincher. Our specialty retail customers include specialized retailers such as Sephora, Douglas, Ulta retail and Space NK, and our DTC customers include e-commerce retailers such as Amazon, ASOS, Cult Beauty and The Hut Group. In 2021, our top two customers each accounted for greater than 10% of our net sales.

Supply Chain and Global Distribution Network

Our finished products are manufactured in the U.S. and Europe by three manufacturers, two in the U.S. with multiple facilities and one in Europe. Cosway Company Inc. manufactures products that accounted for more than 75% of our net sales in 2021 and we continue to rely upon Cosway to manufacture a majority of our current product offerings. Our agreement with Cosway expires on January 1, 2023 and automatically renews for subsequent periods of two years each, unless terminated by either party upon 180 days’ notice. Either party also may terminate the agreement upon the event of breach, default, or bankruptcy. Upon termination of our relationship, Cosway will return or destroy all confidential information and provide us with all formulas that were developed exclusively for us under the agreement along with any related manufacturing know-how. We utilize third parties with key operational facilities located inside and outside the U.S. to warehouse and distribute our products for sale throughout the world. We believe that our manufacturing and distribution network is sufficient to meet current and reasonably anticipated increased requirements. In addition, we have disaster recovery programs in place under some of our agreements with suppliers that allow for shifting of manufacturing capacity if necessary to account for disruptions due to natural disasters and other events outside of our or their control. We continue to implement improvements in capacity, technology, resiliency and productivity and to align our manufacturing and distribution capabilities with anticipated regional sales demand and expansion of our customer base in targeted geographies. In 2021, we launched three new international third party warehouse and logistics centers as well as a new contract manufacturer in Europe.

Our products rely on a single or limited number of suppliers. For example, a principal raw material for our products is Bis-amino, which is manufactured using our patented process by a contract manufacturing organization in the U.S.. Other raw materials used in our products include specialty ingredients and essential oils. Despite our use of a limited number of suppliers, we believe our suppliers have adequate resources and facilities to overcome most unforeseen interruptions of

15

Table of Contents

supply, and we are often able to leverage our relationships with suppliers to obtain raw materials directly while bypassing intermediaries. In the past, we have been able to obtain an adequate supply of essential raw materials and currently believe we have adequate sources of supply for virtually all components of our products, including by maintaining a supply of Bis-amino.

Seasonality

Our results of operations typically are slightly higher in the second half of the fiscal year due to increased levels of purchasing by consumers for special and holiday events and by retailers for the holiday selling seasons. However, fluctuations in net sales in any fiscal quarter may be attributable to the level and scope of new product introductions or the particular promotional calendars followed by our retail customers, which may impact their order placement and receipt of goods.

Competition

Competition in the haircare industry is based on a variety of factors, including innovation, effectiveness of beneficial attributes, accessible pricing, service to the consumer, promotional activities, advertising, special events, new product introductions, e-commerce initiatives and other activities. Our competitors include Henkel AG & Co. KGaA, Kao Corporation, L’Oreal S.A. and Unilever. We also face competition from a number of independent brands. Certain of our competitors also have ownership interests in retailers that are customers of ours.

The continued strength of our brand and products is based on our ability to compete with other companies in our industry. We compete primarily by:

•developing quality products with innovative performance features;

•educating consumers, retail customers and salon professionals about the benefits of our products;

•anticipating and responding to changing consumer, retail customer and salon professional demands in a timely manner, including the timing of new product introductions and line extensions;

•offering products at compelling and accessible price points across channels and geographies;

•maintaining favorable brand recognition;

•developing and sustaining our relationships with our key customers;

•ensuring product availability through effective planning and replenishment collaboration with our customers;

•leveraging e-commerce, social media and the influence of our brand ambassadors and developing an effective omni-channel strategy to optimize the opportunity for consumers to interact with and purchase our products both on-line and in brick and mortar outlets;

•attracting and retaining key personnel;

•maintaining and protecting our intellectual property;

•maintaining an effective manufacturing and distributor network; and

•obtaining and retaining sufficient retail distribution and display space, optimal in-store positioning and effective presentation of our products on retailer’s shelves.

We believe we have a well-recognized and strong reputation in our core markets and that the quality and performance of our products, our emphasis on innovation, and engagement with our professional and consumer community position us to compete effectively.

Intellectual Property

We rely on a combination of patent, trademark, copyright, trade secret, and other intellectual property laws, nondisclosure and assignment of inventions agreements and other measures to protect our intellectual property.

As of December 31, 2021, we owned over 300 trademark registrations and applications globally. Our flagship trademark is OLAPLEX. We seek to register our OLAPLEX mark in all jurisdictions where we do business. In addition, as of

16

Table of Contents

December 31, 2021, we owned over 150 issued patents worldwide, including 14 U.S. patents, and over 50 pending patent applications worldwide.

Our patent portfolio includes a family of patents that includes approximately 95 granted patents with claims that cover Olaplex’s commercial formulations Nos. 0-8, as well as their uses, and patents with claims that cover other haircare and skincare products and/or their uses. The patents issued in this family have been granted in the U.S., Australia, throughout Europe, Brazil, Canada, Israel, New Zealand, and Japan. The patents in this family are generally expected to expire in 2034. Any additional patents that grant from pending applications in this patent family would also be expected to expire in 2034.

Our patent portfolio also includes a family of patents with claims to defend against the use of competitors’ products that do not contain our Bis-amino ingredient. This patent family includes approximately 45 patents that have been granted in the U.S., throughout Europe, Brazil, Canada, Israel, and Japan. The patents in this family are generally expected to expire in 2035. Any additional patents that grant from pending applications in this patent family would also be expected to expire in 2035.

For more information, see “Risk Factors— Risks Related to Intellectual Property Matters.”

Information Technology

Information technology supports all aspects of our business, including operations, marketing, sales, order processing, production and distribution networks, customer and customer experience, finance, business intelligence, and product development. We continue to maintain and enhance our information technology systems and customer experiences in alignment with our long-term strategy. An increasing portion of our global information technology infrastructure is cloud-based and in partnership with industry-leading service providers. This approach allows for a more scalable platform to support current and future requirements and improves our agility and flexibility to respond to the demands of the business by leveraging advanced and leading-edge technologies.

We recognize that technology presents opportunities for competitive advantage, and we continue to invest in new capabilities across various aspects of our business. During 2021, we continued to improve our business-to-business and business-to-consumer integration, cybersecurity and technology infrastructure, supply chain integration, business resilience capabilities and analytics. In addition, we improved our e-commerce experience, launched DTC sites in the U.K., Australia, Italy, and Spain; continued our investment in business intelligence to drive deeper consumer insight, and built a Spanish language certification and education site for our professional hairstylist and consumer community.

In 2021 we expanded our data privacy program to protect our customers and our business and to align with the privacy regulations of countries in which we do business. We also have enhanced and will continue to enhance our cybersecurity profile to align with industry standard cybersecurity frameworks. We review and assess our cybersecurity profile on an ongoing basis, and our policies and procedures establish processes for risk assessment, risk management, risk oversight, end user training, third-party reviews and general cybersecurity. We have assessed, and will continue to assess, the adequacy of our policies, procedures, and internal controls for ensuring we meet defined cyber security standards.

Properties

We do not own any real property or have a physical headquarters. We lease one facility in New York that we use for research and development. We amended this lease on October 29, 2021 to add additional space and extend the lease term to end on January 31, 2025. Our employees work remotely, from home or at shared co-working office spaces. We believe these arrangements support our current needs.

Employees and Human Capital Resources

Employees

As of December 31, 2021, Olaplex employed 106 employees, 103 of which are based in the U.S. and three of which are based in the U.K. We also leverage contractors to supplement work in areas that are quickly growing such as technology, operations and accounting. We do not have any employees governed by a union. We utilize a professional employer organization (“PEO”), who is the employer of record of our U.S. employees and administers our human resources, payroll and employee benefits functions.

Since the Acquisition in January 2020, we have hired 82 employees, focusing primarily on building key capabilities at the executive level, organizational capabilities such as human resources, information technology, legal, operations, finance and accounting, sales and marketing.

Culture

17

Table of Contents

We believe our commitment to our heritage in the haircare space and encouragement of our employees to bring their whole self to work has created a culture that is paramount to our success. We embrace our employees’ families as our own, one another as friends and celebrate life events as if we were together. We are passionate about what we do, how our products impact lives and what our brand means to our community.

Diversity, Equity, and Inclusion

Diversity, Equity, and Inclusion remains a key differentiator in both our consumer strategy and internal culture. We remain committed to supporting and standing up for our community with our talent, content, message and product offering. As of December 31, 2021, 76% of our employees identify as female and 46% identify as non-white. We know through experience that different ideas, perspectives and backgrounds create a stronger and more creative work environment that can deliver better results.

In January 2021, we established DEI Champions who reinforce our collective commitment to foster a diverse, equitable and inclusive culture. Their roles are to identify opportunities to further engage our teammates through training and education, encouraging candid conversations and leading by example. The team is led by six individual volunteers across different departments and have a strong representation of race and sexual orientation.

Compensation and Benefits

The core objective of our compensation program is to provide a package that will attract, motivate and reward exceptional employees. Through our “Healthy Hair ~ Healthy Body ~ Healthy Mind” wellness strategy, we are committed to providing comprehensive benefit options that will allow our employees and their families to live healthier and more secure lives. We leverage both formal and informal programs to identify, foster and retain top talent.

Government Regulation

Our cosmetic products are subject to regulation by the Food and Drug Administration (“FDA”) and the Federal Trade Commission (“FTC”) in the U.S., as well as various other local and foreign regulatory authorities, including those in the European Union (“E.U.”), and other countries in which we operate. These laws and regulations principally relate to the ingredients, proper labeling, advertising, packaging, marketing, manufacture, safety, shipment and disposal of our products.

The Federal Food, Drug and Cosmetic Act (“FDCA”), defines cosmetics as articles or components of articles intended for application to the human body to cleanse, beautify, promote attractiveness, or alter the appearance, with the exception of soap. The labeling of cosmetic products is subject to the requirements of the FDCA, the Fair Packaging and Labeling Act, the Poison Prevention Packaging Act and other FDA regulations. Cosmetics are not subject to pre-market approval by the FDA; however, certain ingredients, such as color additives, must be pre-approved for the specific intended use of the product and are subject to certain restrictions on their use. If a company has not adequately substantiated the safety of its products or ingredients by, for example, performing appropriate toxicological tests or relying on already available toxicological test data, then a specific warning label is required. The FDA may, by regulation, require other warning statements on certain cosmetic products for specified hazards associated with such products. FDA regulations also prohibit or otherwise restrict the use of certain types of ingredients in cosmetic products.

In addition, the FDA requires that cosmetic labeling and claims be truthful and not misleading. Moreover, cosmetics may not be marketed or labeled for their use in treating, preventing, mitigating, or curing disease or other conditions or in affecting the structure or function of the body, as such claims would render the products to be a drug and subject to regulation as a drug. The FDA has issued warning letters to cosmetic companies alleging improper drug claims regarding their cosmetic products, including, for example, product claims regarding hair growth or preventing hair loss. In addition to FDA requirements, the FTC as well as state consumer protection laws and regulations can subject a cosmetics company to a range of requirements and theories of liability, including similar standards regarding false and misleading product claims, under which FTC or state enforcement or class-action lawsuits may be brought.

In the U.S., the FDA has not promulgated regulations establishing Good Manufacturing Practices (“GMPs”) for cosmetics. However, FDA’s draft guidance on cosmetic GMPs, most recently updated in June 2013, provides recommendations related to process documentation, recordkeeping, building and facility design, equipment maintenance and personnel, and compliance with these recommendations can reduce the risk that FDA finds such products have been rendered adulterated or misbranded in violation of applicable law. FDA also recommends that manufacturers maintain product complaint and recall files and voluntarily report adverse events to the agency. The FDA monitors compliance of cosmetic products through market surveillance and inspection of cosmetic manufacturers and distributors to ensure that the products are not manufactured under unsanitary conditions, or labeled in a false or misleading manner. Inspections also may arise from consumer or competitor complaints filed with the FDA. In the event the FDA identifies unsanitary conditions, false or misleading labeling, or any other violation of FDA regulation, FDA may request or a manufacturer may independently

18

Table of Contents

decide to conduct a recall or market withdrawal of product or to make changes to its manufacturing processes or product formulations or labels.

The FTC also regulates and can bring enforcement action against cosmetic companies for deceptive advertising and lack of adequate scientific substantiation for claims. The FTC requires that companies have a reasonable basis to support marketing claims. What constitutes a reasonable basis can vary depending on the strength or type of claim made, or the market in which the claim is made, but objective evidence substantiating the claim is generally required.

The FTC also has specialized requirements for certain types of claims. For example, the FTC’s “Green Guides” regulate how “free-of,” “non-toxic” and similar claims must be framed and substantiated. In addition, the FTC regulates the use of endorsements and testimonials in advertising as well as relationships between advertisers and social media influencers pursuant to principles described in the FTC’s Endorsement Guides. The Endorsement Guides provide that an endorsement must reflect the honest opinion of the endorser, based on “bona fide” use of the product, and cannot be used to make a claim about a product that the product’s marketer could not itself legally make. Additionally, companies marketing a product must disclose any material connection between an endorser and the company that consumers would not expect that would affect how consumers evaluate the endorsement. If an advertisement features endorsements from people who achieved exceptional, or even above average, results from using a product, the advertiser must have proof that the endorser’s experience can generally be achieved using the product as described; otherwise, an advertiser must clearly communicate the generally expected results of a product and have a reasonable basis for such representations.